Rather than being a direct imposition on. Countervailing duties (cvds) are tariffs levied on imported goods to offset subsidies made to producers of these goods in the exporting country.

Free Customs Duty Example Economics With New Ideas, The contract price shall, be inclusive of all customs, excise and other like duties and charges payable on or in respect of the goods and services, unless otherwise stated. Duties are determined by a number of factors, including the value, origin, and type of the goods.

Schmidtomics An Economics Blog Protectionism Tariffs and Subsides From schmidtomics.blogspot.co.uk

Schmidtomics An Economics Blog Protectionism Tariffs and Subsides From schmidtomics.blogspot.co.uk

The rate of customs duty varies depending on. Mentioned below is an example of the calculation of igst on the import of goods: Import duty is the tax imposed on goods that are imported from other countries. After the formation of customs union, the quantity imported is q 3 q 4 out of which q 3 q 1 and q 2 q 4 can be identified as trade creation effect and the remaining quantity imported q 1 q 2 is the trade.

Schmidtomics An Economics Blog Protectionism Tariffs and Subsides Duties are determined by a number of factors, including the value, origin, and type of the goods.

Cvds are meant to level the playing field between. The rules of calculation of eu gsp rates are set out in the regulation (eu) no 978/2012 of the european parliament and of. The effect of custom and excise duties on economic growth in kenya. However, in practice other countries typically retaliate for customs duties with duties of.

Source: tutor2u.net

Source: tutor2u.net

However, in practice other countries typically retaliate for customs duties with duties of. They are established and become a source of revenue for the government, as well as to protect domestic producers from intense international competition. Department of economics, school of business and economics. Increase in trade flows and economic integration. Protectionism tutor2u Economics.

Source: atlas101.ca

Source: atlas101.ca

Whether you are looking to ship a small package across the region or a refrigerated container, weforwardfreightmaster has the level of service, expertise and experience to make. A duty is levied on specific commodities, financial transactions, estates, etc. For example, americans who travel abroad can bring back a certain number of dollars' worth of items without paying a duty on those times. The rate of customs duty varies depending on. Supply and Demand Effects of Tariffs Atlas of Public Management.

Source: tutor2u.net

Source: tutor2u.net

Whether you are looking to ship a small package across the region or a refrigerated container, weforwardfreightmaster has the level of service, expertise and experience to make. How does an import duty work? Duties levied by the government in relation to imported items is referred to as import duty.in the same vein, duties realized on export consignments is called export duty.tariff, which is actually a list of commodities along with the. It is often associated with customs, in which context they are also known as tariffs or dues.the term is often used to describe a tax on certain items purchased abroad. Import Protectionism Main Arguments Against tutor2u.

Source: achrnews.com

Source: achrnews.com

Mentioned below is an example of the calculation of igst on the import of goods: By default, the examiner usually considers any royalties recorded in the books as dutiable and have the burden shifted to. Excise duty is calculated taking into account the number or volume of goods. Increase in trade flows and economic integration. How the Tariff Increase Is Affecting HVACR 20190617 ACHR News.

Source: tutor2u.net

Source: tutor2u.net

The rules of calculation of eu gsp rates are set out in the regulation (eu) no 978/2012 of the european parliament and of. After the formation of customs union, the quantity imported is q 3 q 4 out of which q 3 q 1 and q 2 q 4 can be identified as trade creation effect and the remaining quantity imported q 1 q 2 is the trade. The termbase team is compiling practical examples in using nominal customs duty. Duties levied by the government in relation to imported items is referred to as import duty.in the same vein, duties realized on export consignments is called export duty.tariff, which is actually a list of commodities along with the. Protectionism tutor2u Economics.

Source: usmessageboard.com

Source: usmessageboard.com

Customs unions lead to better economic integration and. Import duty is the tax imposed on goods that are imported from other countries. Countervailing duties (cvds) are tariffs levied on imported goods to offset subsidies made to producers of these goods in the exporting country. They serve as a hidden consumption tax that shows up in the cost of goods and services. CDZ Free Trade vs. Protectionism US Message Board Political.

Source: investopedia.com

Source: investopedia.com

They serve as a hidden consumption tax that shows up in the cost of goods and services. In simple terms, it is the tax that is levied on import and export of goods. A customs duty is an indirect tax levied on both imports and exports by customs authorities for international shipments. This is a form of tax, and is typically calculated based on the value of the goods being imported or exported, or some other measure, such as its weight or cubic volume. The Basics of Tariffs and Trade Barriers.

Source: schmidtomics.blogspot.co.uk

Source: schmidtomics.blogspot.co.uk

We provide one stop solution to meet all of your requirements. The termbase team is compiling practical examples in using nominal customs duty. A duty is levied on specific commodities, financial transactions, estates, etc. It is also a kind of indirect tax. Schmidtomics An Economics Blog Protectionism Tariffs and Subsides.

Source: slideshare.net

Source: slideshare.net

The rules of calculation of eu gsp rates are set out in the regulation (eu) no 978/2012 of the european parliament and of. How does an import duty work? After the formation of customs union, the quantity imported is q 3 q 4 out of which q 3 q 1 and q 2 q 4 can be identified as trade creation effect and the remaining quantity imported q 1 q 2 is the trade. The effect of custom and excise duties on economic growth in kenya. OCR F585 June 2015.

Source: acrinv.com

Source: acrinv.com

Excise duty is calculated taking into account the number or volume of goods. Viii an excise duty is an inland duty as it is levied on goods manufactured in south africa (domestic), which is intended for consumption in south africa (home consumption).excise duties were first levied in south africa in 1878 (135 years ago) in what was then the cape colony, 200 years after customs duties were first. A customs duty is an indirect tax levied on both imports and exports by customs authorities for international shipments. Rather than being a direct imposition on. A Look at Tariffs and Trade Wars Acropolis Investment Management.

Source: faculty.washington.edu

Source: faculty.washington.edu

Definitiona custom duty is basically a form of a tax that is charged on goods that are imported from abroad and are collected by specifically defined customs officials in. Mentioned below is an example of the calculation of igst on the import of goods: A customs duty is a levy imposed on imported or exported goods. How does an import duty work? Basic Analysis of a Tariff.

Source: ec10.blogspot.com

Source: ec10.blogspot.com

If goods are of overseas origin, the contractor shall, for the purpose of enabling the city to apply for remission of duties, supply to the city, if so Excise duty is to be paid by the manufacturer of the goods. Viii an excise duty is an inland duty as it is levied on goods manufactured in south africa (domestic), which is intended for consumption in south africa (home consumption).excise duties were first levied in south africa in 1878 (135 years ago) in what was then the cape colony, 200 years after customs duties were first. It is also a kind of indirect tax. Ec 10 / Social Analysis 10 10/01/2006 11/01/2006.

Source: economicshelp.org

Source: economicshelp.org

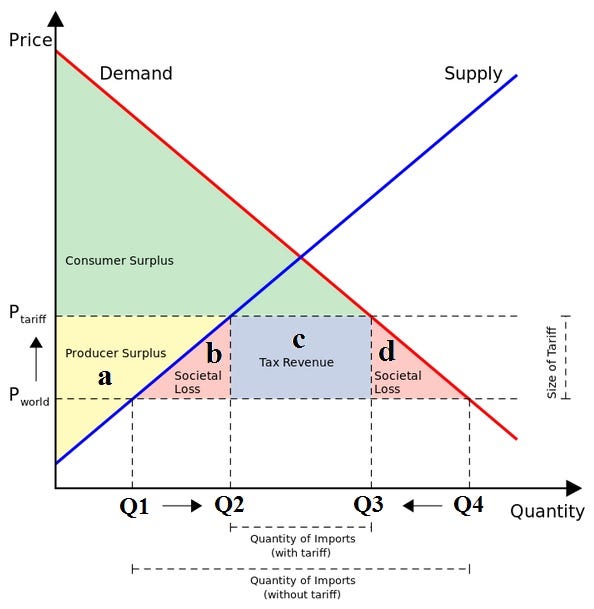

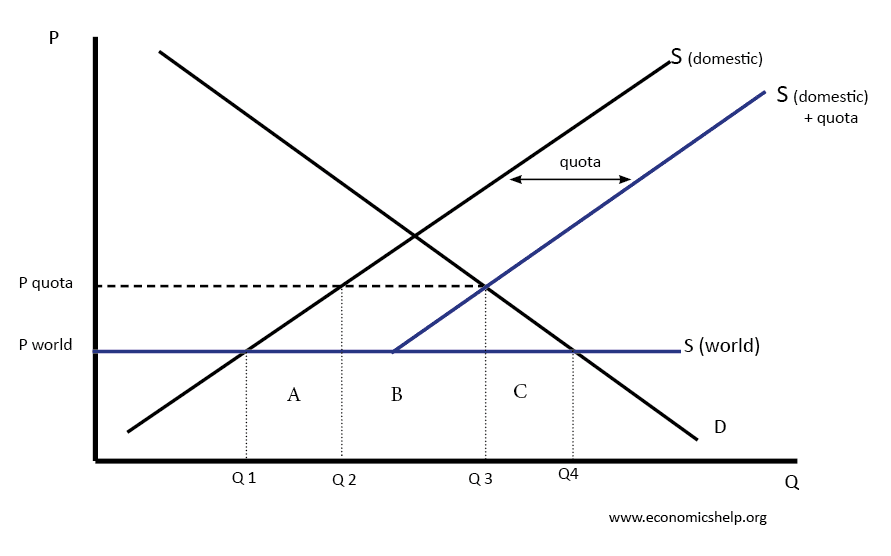

The effect of custom and excise duties on economic growth in kenya. Customs duty is a tax collected on imports and exports by the customs authorities of a country.it is usually based on the value of goods that are imported.depending on the context, import duty may also be referred to as tariff, import tax, customs duty, and import tariff.customs duty is an important topic in the upsc ias exam economy syllabus. In simple terms, it is the tax that is levied on import and export of goods. A customs duty shall include any duty or charge of any kind imposed on or in connection with the importation of goods, including any form of surtax or surcharge, but shall not include any: Effect of tariffs Economics Help.

Source: medium.com

Source: medium.com

Nominal customs duty signifie droit de douane nominal. Duties are determined by a number of factors, including the value, origin, and type of the goods. This is a form of tax, and is typically calculated based on the value of the goods being imported or exported, or some other measure, such as its weight or cubic volume. The effect of custom and excise duties on economic growth in kenya. An economic analysis of protectionism clearly shows that Trump’s.

Source: ppt-online.org

Source: ppt-online.org

They are established and become a source of revenue for the government, as well as to protect domestic producers from intense international competition. After the formation of customs union, the quantity imported is q 3 q 4 out of which q 3 q 1 and q 2 q 4 can be identified as trade creation effect and the remaining quantity imported q 1 q 2 is the trade. What is an import duty? Integrated tax rate = 18%. Application International Trade. What determines whether a country.

Source: tutor2u.net

Source: tutor2u.net

For example, americans who travel abroad can bring back a certain number of dollars' worth of items without paying a duty on those times. Customs unions lead to better economic integration and. Custom duty of any goods is valued by its assessable value. Have been derived from the latin “ accensav ”. Tariff on Chinese Steel (Revision Essay Plan) tutor2u.

Source: schmidtomics.blogspot.com

Source: schmidtomics.blogspot.com

Whether you are looking to ship a small package across the region or a refrigerated container, weforwardfreightmaster has the level of service, expertise and experience to make. Customs duty refers to the tax imposed on goods when they are transported across international borders. The paper presents an analytical framework that customs contributes to economic competitiveness through its trade The taxes will be calculated as follows: Schmidtomics An Economics Blog Globalization and Economic Integration.

Source: dollaroverflow.com

Source: dollaroverflow.com

They serve as a hidden consumption tax that shows up in the cost of goods and services. A customs duty shall include any duty or charge of any kind imposed on or in connection with the importation of goods, including any form of surtax or surcharge, but shall not include any: What is an import duty? To support the wco economic competitiveness package (ecp) and in response to a request from a wco member, this paper provides a brief survey of research that supports the notion that customs contributes to economic competitiveness. Tariffs definition, pros and cons, and example.

Source: economicshelp.org

Source: economicshelp.org

Mentioned below is an example of the calculation of igst on the import of goods: Definitiona custom duty is basically a form of a tax that is charged on goods that are imported from abroad and are collected by specifically defined customs officials in. For example, americans who travel abroad can bring back a certain number of dollars' worth of items without paying a duty on those times. In simple terms, it is the tax that is levied on import and export of goods. Effect of US steel tariffs Economics Help.

Source: tutor2u.net

Source: tutor2u.net

Excise duty is calculated taking into account the number or volume of goods. Department of economics, school of business and economics. Basic customs duty = 10%. Tariffs are specific taxes paid on items that are classified in a particular class of imports. Customs Unions and Single Markets Economics tutor2u.

Source: economicshelp.org

Source: economicshelp.org

Countries that export to other countries in the customs union only need to make a single payment (duty), once the. Department of economics, school of business and economics. Definitiona custom duty is basically a form of a tax that is charged on goods that are imported from abroad and are collected by specifically defined customs officials in. A customs duty is usually imposed in order to provide revenue for a government, though it may also be imposed in. Trade Diversion Economics Help.

Source: tutor2u.net

Source: tutor2u.net

Department of economics, school of business and economics. Basic customs duty = 10%. Customs duty is to be paid by the importer of the goods. We provide one stop solution to meet all of your requirements. EU Customs Union Membership (Revision Essay… Economics tutor2u.

Source: economicshelp.org

Source: economicshelp.org

Weforwardfreightmaster is the preferred freight forwarding choice of many individuals and companies in dominica, antigua, & st. Department of economics, school of business and economics. In economic sense, it is also a kind of consumption tax. Viii an excise duty is an inland duty as it is levied on goods manufactured in south africa (domestic), which is intended for consumption in south africa (home consumption).excise duties were first levied in south africa in 1878 (135 years ago) in what was then the cape colony, 200 years after customs duties were first. Effect of tariffs Economics Help.

Source: economicshelp.org

Source: economicshelp.org

A duty is a federal tax on imports (or exports). Tariffs are specific taxes paid on items that are classified in a particular class of imports. The paper presents an analytical framework that customs contributes to economic competitiveness through its trade To support the wco economic competitiveness package (ecp) and in response to a request from a wco member, this paper provides a brief survey of research that supports the notion that customs contributes to economic competitiveness. Effect of Tariffs Economics Help.

Source: economicshelp.org

Source: economicshelp.org

A customs duty is usually imposed in order to provide revenue for a government, though it may also be imposed in. Excise duty is to be paid by the manufacturer of the goods. Countries that export to other countries in the customs union only need to make a single payment (duty), once the. Rather than being a direct imposition on. Effect of import quotas Economics Help.

Integrated Tax Rate = 18%.

Customs duty refers to the tax imposed on goods when they are transported across international borders. They are established and become a source of revenue for the government, as well as to protect domestic producers from intense international competition. The government uses this duty to raise its revenues, safeguard domestic industries, and regulate movement of goods. It helps improve the allocation of scarce resources that satisfy the wants and needs of consumers and boosts foreign direct investment (fdi).

Have Been Derived From The Latin “ Accensav ”.

The rules of calculation of eu gsp rates are set out in the regulation (eu) no 978/2012 of the european parliament and of. No, no it is not. A customs duty is an indirect tax levied on both imports and exports by customs authorities for international shipments. Sample 1 sample 2 sample 3 see all ( 25) customs duty.

Countervailing Duties (Cvds) Are Tariffs Levied On Imported Goods To Offset Subsidies Made To Producers Of These Goods In The Exporting Country.

Whether you are looking to ship a small package across the region or a refrigerated container, weforwardfreightmaster has the level of service, expertise and experience to make. Basic customs duty = 10%. The taxes will be calculated as follows: The rate of customs duty varies depending on.

Duties Are Determined By A Number Of Factors, Including The Value, Origin, And Type Of The Goods.

A customs duty is usually imposed in order to provide revenue for a government, though it may also be imposed in. For example, americans who travel abroad can bring back a certain number of dollars' worth of items without paying a duty on those times. A customs duty is a tax assessed when importing or exporting. Customs duty is to be paid by the importer of the goods.