Verification of documentation and physical inspection of goods. The charge, related to the use of the equipment only.

Step By Step Indonesia Customs Charges With Creative Design, Importation of goods into indonesia is subject to customs verification, i.e. (total value in idr + import duty) x 10%.

Customs Brokerage Indonesia International Logistik From indonesia-shipping.com

Customs Brokerage Indonesia International Logistik From indonesia-shipping.com

This convention entered into force on 4th november 1952. According to indonesian customs, personal goods of a value ≤ The following items are prohibited without a special license and cannot be carried into indonesia: The charge, related to the use of the equipment only.

Customs Brokerage Indonesia International Logistik When importing goods into indonesia, there are three sorts of taxes to consider:

Total value in idr x percentage of import duty. This guide contains everything you need to know about shipping your belongings to indonesia, including shipping options, costs, customs regulations, and timelines. If you can’t import the goods that are stuck in the customs, you need to export them out of indonesia and acquire the relevant documents/licenses before importing them to indonesia again. In the agricultural sector, tariffs on more than 1,300 products have bindings at or above 35.5 percent.

Source: waste360.com

Source: waste360.com

Politically sensitive material such as printed papers, pictures. 4.1 indonesia government contact list. The following items are prohibited without a special license and cannot be carried into indonesia: On arrival in jakarta, the pet will be held at a Indonesia Finalizes Scrap Import Regulations Waste360.

Source: uhyinternational.co.uk

Source: uhyinternational.co.uk

In the agricultural sector, tariffs on more than 1,300 products have bindings at or above 35.5 percent. This article will take approximately 33 minutes to read. Import duties (depends on the product) value added tax (vat) at 10%. The faim label is your global assurance for a smooth, safe and comprehensive relocation process. Customs duties in US, UK and other developed economies less than half.

Source: blog.boxme.asia

Source: blog.boxme.asia

•in order to ensure a smooth customs clearance, it’s essential that shippers provide complete & accurate data electronically to dhl express. 250usd per person (or ≤ This article will take approximately 33 minutes to read. The following fees will be charged for any special request of mentioned activities. Indonesia tightens import regulations on foreign goods.

Source: emerhub.com

Source: emerhub.com

The amount of tax is determined by the kind of goods imported and the hs code of the product. Import duties (depends on the product) value added tax (vat) at 10%. When importing goods into indonesia, there are three sorts of taxes to consider: Certain types of books, bags. Setting Up an Import Company In Indonesia.

Source: mach1global.com

Source: mach1global.com

Indonesia customs regulations and procedures for importing and exporting goods at indonesian border. When importing goods into indonesia, there are three sorts of taxes to consider: In the agricultural sector, tariffs on more than 1,300 products have bindings at or above 35.5 percent. Commercial service of the u.s. Demurrage Fees and 8 Ways to Avoid Them Mach 1 Global Services.

Source: emerhub.com

Source: emerhub.com

In 2020, indonesia issued minister of finance (mof) regulation 199/2019 to lower the price threshold for import duty exemptions on imported consumer goods (known as “consignment goods”) from $75 to $3. But if you want to get in touch with a shipping company immediately, you can go ahead and fill out this form. Indonesia’s director general of customs and excise reportedly makes a valuation assessment based on the perceived risk status of the importer and the average price of a same or similar product imported during the previous 90 days. Folk handicrafts and hobby goods. How to Calculate Custom Duty and Import Tax in Indonesia Emerhub.

Source: ferrytrans.id

Source: ferrytrans.id

If the shipment value is over indonesia’s de minimis rate of us$ 3, b2c ecommerce shipments are taxed with the following: (total value in idr + import duty) x percentage of income tax. Commercial service of the u.s. If you can’t import the goods that are stuck in the customs, you need to export them out of indonesia and acquire the relevant documents/licenses before importing them to indonesia again. Mengatasi Mahalnya Biaya Import LCL Biaya D/O, Warehouse Charge.

Source: irrawaddy.com

Source: irrawaddy.com

25,000 idr per item will be charged for. Customer must be in country for clearance. Public 2021 indonesia customs regulatory changes overview •customs authorities across the world are increasingly mandating additional data elements for customs clearance purposes. (total value in idr + import duty) x percentage of income tax. Four Mandalay Policemen Face Corruption Charges.

Source: blog.boxme.asia

Source: blog.boxme.asia

We also have an import tax calculator that allows you to estimate all taxes associated with importing a shipment to indonesia. You'll be notified of any charges due on your parcel and you'll have 7 days to make the payment. Import duties (depends on the product) value added tax (vat) at 10%. Customs guide indonesia the global quality standard for international moving. Indonesia tightens import regulations on foreign goods.

Source: blog.boxme.asia

Source: blog.boxme.asia

This is the case, of course, if your products do not fall under. Moreover, it is necessary to pay customs charges and import taxes in advance, as well as notify customs of arriving freight. The actual value is determined by the hs code of the goods being imported into indonesia. Verification of documentation and physical inspection of goods. Indonesia tightens import regulations on foreign goods.

Source: mirandahlaw.com

Source: mirandahlaw.com

According to indonesian customs, personal goods of a value ≤ Politically sensitive material such as printed papers, pictures. Importation of goods into indonesia is subject to customs verification, i.e. The embassy of the republic of indonesia 2020 massachusetts ave nw washington, dc 20036 u.s.a. New Indonesia Customs Regulation for Protection of IP Rights.

Source: abyasiasepakat.com

Source: abyasiasepakat.com

The charge, related to the use of the equipment only. 63 rows shipping to indonesia can be expensive as the referred to indonesian custom website, most of. Moreover, it is necessary to pay customs charges and import taxes in advance, as well as notify customs of arriving freight. In the agricultural sector, tariffs on more than 1,300 products have bindings at or above 35.5 percent. Customs Brokerages Agent PT ABY ASIA SEPAKAT.

Source: conventuslaw.com

Source: conventuslaw.com

Moreover, it is necessary to pay customs charges and import taxes in advance, as well as notify customs of arriving freight. You can import but duty charges of approx. You'll be notified of any charges due on your parcel and you'll have 7 days to make the payment. Subject to additional 3rd party charges where applicable, such as, port tariff and its inspection charges and penalty charges, container depot tariff and cleaning/repair tariff, and government agency tariff as per declared hs code, i.e., duty and tax charges, red lane/customs inspection charges, quarantine charges, food & drug administration. Indonesia Intangible Goods Are Now Subject To Import Duty.

Source: independent.co.uk

Source: independent.co.uk

Importation of goods into indonesia is subject to customs verification, i.e. The embassy of the republic of indonesia 2020 massachusetts ave nw washington, dc 20036 u.s.a. Import duties (depends on the product) value added tax (vat) at 10%. Total value in idr x percentage of import duty. British man faces death penalty in Indonesia on drugsmuggling charges.

Source: medium.com

Source: medium.com

(beacukai.co.id) customs duties and taxes on imports customs threshold (from which tariffs are required) usd 50 average customs duty (excluding agricultural products) 9.5% (2006) products having a higher customs tariff the highest rates of duty are levied on alcoholic drinks (80 to 90%), and cars (60%). You can import but duty charges of approx. Folk handicrafts and hobby goods. To help avoid being surprised by any unexpected charges, we'd suggest contacting your local customs office before placing your order. Customs Clearance in Southeast Asia Guide for B2C Business.

Source: nltimes.nl

Source: nltimes.nl

This guide contains everything you need to know about shipping your belongings to indonesia, including shipping options, costs, customs regulations, and timelines. In indonesia, the value added tax (vat) is set at 10%. Please note that indonesia has a reputation for its officials charging money for things they should not charge money for (i.e., corruption). The shipper / consignee / receiver / etc. Albert Heijn heir avoids death penalty in Indonesia on drug charges.

Source: indonesia-shipping.com

Source: indonesia-shipping.com

The actual value is determined by the hs code of the goods being imported into indonesia. This article will take approximately 33 minutes to read. You can import but duty charges of approx. 63 rows shipping to indonesia can be expensive as the referred to indonesian custom website, most of. Customs Brokerage Indonesia International Logistik.

Source: lfsgroup.org

Source: lfsgroup.org

Please note that indonesia has a reputation for its officials charging money for things they should not charge money for (i.e., corruption). The faim label is your global assurance for a smooth, safe and comprehensive relocation process. Firearms, explosives, ammunition (need special license) guns, sport weapons/hunting guns (need special license) description of goods. But if you want to get in touch with a shipping company immediately, you can go ahead and fill out this form. News LFS GLOBAL LOGISTICS Indonesia Relaxes Import Regulations.

(total value in idr + import duty) x percentage of income tax. Importation of electronic equipment is not permitted. Moreover, it is necessary to pay customs charges and import taxes in advance, as well as notify customs of arriving freight. In 2020, indonesia issued minister of finance (mof) regulation 199/2019 to lower the price threshold for import duty exemptions on imported consumer goods (known as “consignment goods”) from $75 to $3. Armed Indonesian customs officers guard two Iranians arrested on drug.

Source: ferrytrans.id

Source: ferrytrans.id

Customer must be in country for clearance. The actual value is determined by the hs code of the goods being imported into indonesia. 25,000 idr per item will be charged for. According to pmk 199/2019 issued by the ministry of finance, the maximum. Mengatasi Mahalnya Biaya Import LCL Biaya D/O, Warehouse Charge.

Source: multi-consolidatama.com

Source: multi-consolidatama.com

Commercial or merchandised goods are not allowed. You can import but duty charges of approx. Local charges [local customer service charges indonesia last update : Please note that indonesia has a reputation for its officials charging money for things they should not charge money for (i.e., corruption). Custom Clearance « PT. MULTI LINTAS CONSOLIDATAMA.

Source: aseanbriefing.com

Source: aseanbriefing.com

•in order to ensure a smooth customs clearance, it’s essential that shippers provide complete & accurate data electronically to dhl express. 63 rows shipping to indonesia can be expensive as the referred to indonesian custom website, most of. Folk handicrafts and hobby goods. According to pmk 199/2019 issued by the ministry of finance, the maximum. Import and Export Procedures in Malaysia Best Practices ASEAN.

Source: cbsnews.com

Source: cbsnews.com

This convention entered into force on 4th november 1952. For contact information regarding government custom authorities, please follow the link below: 63 rows shipping to indonesia can be expensive as the referred to indonesian custom website, most of. Subject to additional 3rd party charges where applicable, such as, port tariff and its inspection charges and penalty charges, container depot tariff and cleaning/repair tariff, and government agency tariff as per declared hs code, i.e., duty and tax charges, red lane/customs inspection charges, quarantine charges, food & drug administration. Bali drug arrests see Indonesia hold American man along with Australian.

Source: countryaah.com

Source: countryaah.com

Moreover, it is necessary to pay customs charges and import taxes in advance, as well as notify customs of arriving freight. If the shipment value is over indonesia’s de minimis rate of us$ 3, b2c ecommerce shipments are taxed with the following: (total value in idr + import duty) x percentage of income tax. But if you want to get in touch with a shipping company immediately, you can go ahead and fill out this form. Indonesia Import Restrictions.

Source: thejakartapost.com

Source: thejakartapost.com

This is the case, of course, if your products do not fall under. Indonesia customs regulations and procedures for importing and exporting goods at indonesian border. Import duties (depends on the product) value added tax (vat) at 10%. Commercial service of the u.s. Indonesia relaxes import regulations for 6 commodities Business The.

Please Note That Indonesia Has A Reputation For Its Officials Charging Money For Things They Should Not Charge Money For (I.e., Corruption).

Import duties (depends on the product) value added tax (vat) at 10%. Department of commerce utilizes its global presence and international marketing. Import in brief any goods coming from overseas into the indonesian customs territory are treated as “import” and are generally subject to import duty. On arrival in jakarta, the pet will be held at a

Firearms, Explosives, Ammunition (Need Special License) Guns, Sport Weapons/Hunting Guns (Need Special License) Description Of Goods.

Customs guide indonesia the global quality standard for international moving. The embassy of the republic of indonesia 2020 massachusetts ave nw washington, dc 20036 u.s.a. But if you want to get in touch with a shipping company immediately, you can go ahead and fill out this form. 25,000 idr per item will be charged for.

We Also Have An Import Tax Calculator That Allows You To Estimate All Taxes Associated With Importing A Shipment To Indonesia.

In indonesia, the value added tax (vat) is set at 10%. Politically sensitive material such as printed papers, pictures. This article will take approximately 33 minutes to read. (total value in idr + import duty) x percentage of income tax.

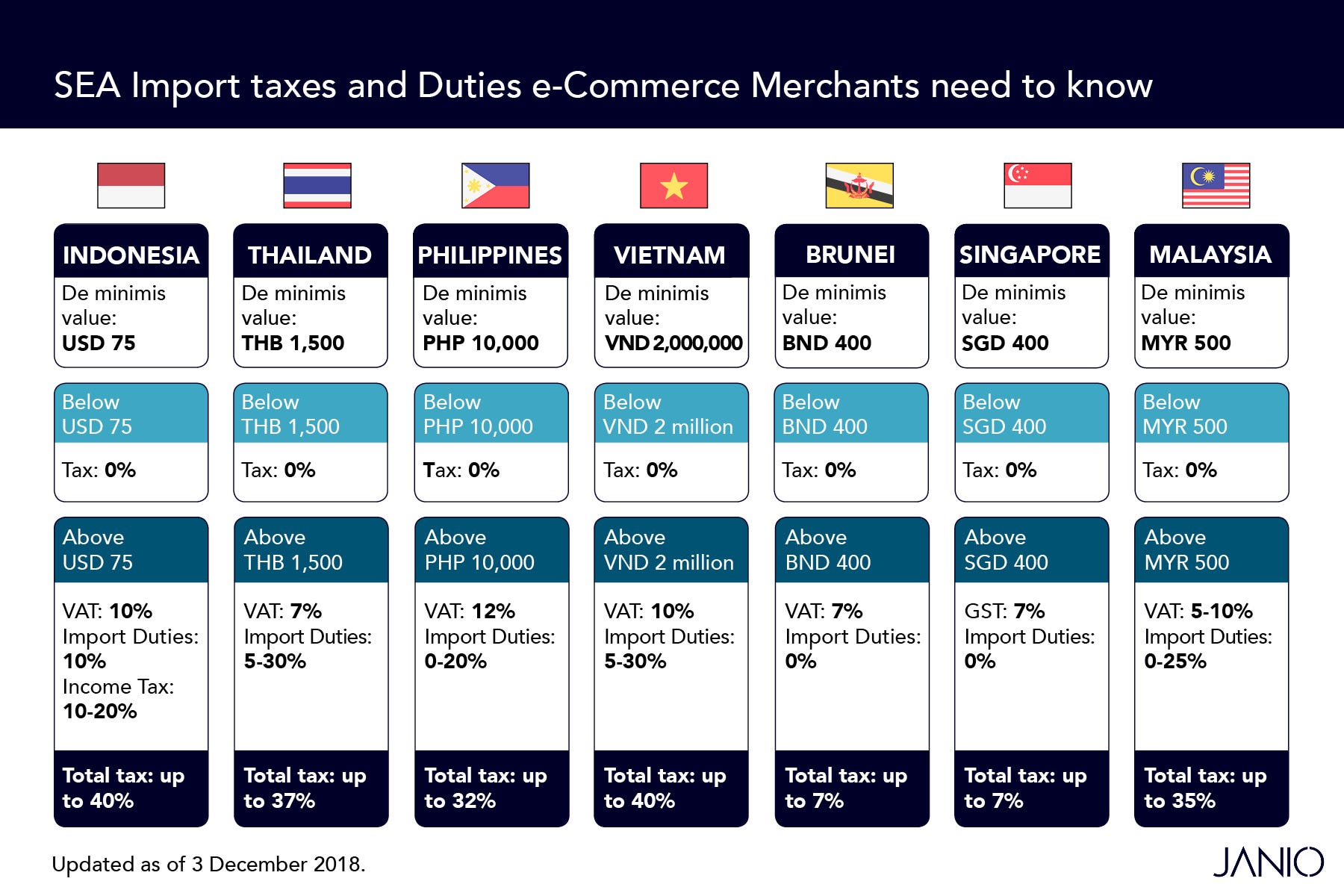

Amount Of Usd 3 That The Indonesian Government Allowed To Obtain Free Tax Compared To The Countries Around Indonesia Is Comparably Low, As Singapore Has Free Custom Duty Up To Sgd 400 = Usd 250, Malaysia Up To Myr 500 =.

(beacukai.co.id) customs duties and taxes on imports customs threshold (from which tariffs are required) usd 50 average customs duty (excluding agricultural products) 9.5% (2006) products having a higher customs tariff the highest rates of duty are levied on alcoholic drinks (80 to 90%), and cars (60%). Indonesian customs guide 2019 9 import a. You can import but duty charges of approx. As customs charges vary widely from country to country we're not able to predict what these charges will be.